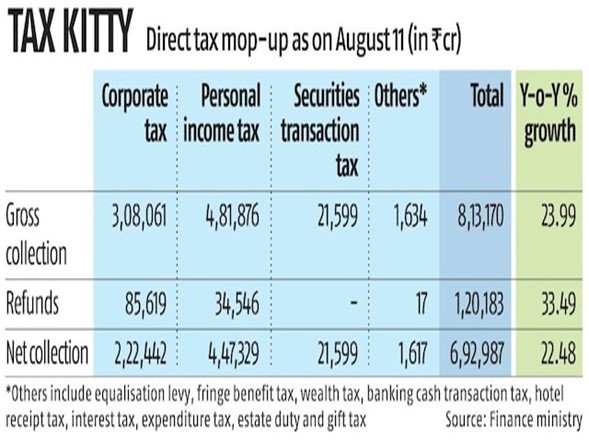

India’s net direct tax collection, with refunds adjusted, grew 22.5% to Rs 6.93 trillion between April 1 and August 11 of FY25. In the same period last year, tax collection was at Rs 5.65 trillion, according to the Income-Tax (I-T) Department’s latest data released on Monday. Of the tax mop-up, personal income-tax (PIT) outpaced corporation tax. PIT stood at Rs 4.47 trillion (net) as against Rs 3.44 trillion in the same period a year ago. Corporation tax reported at Rs 2.2 trillion, an increase of 5.7%, which is lower than the growth rate of 12% set for this financial year. Direct taxes comprise PIT and corporation tax. Securities transaction tax, part of PIT, has jumped to Rs 21,599 crores from Rs 10,234 crores in the same period a year ago.

This could be attributed to changes in tax rates and increase in stock-market trading.

Gross collection (before refunds) stood at Rs 8.13 trillion, marking a 23.99% rise from the previous financial year, according to the Tax Department. The Government has issued direct tax refunds of Rs 1.20 trillion till August 11. That is an increase of 33.49% over Rs 90,028 crores in the corresponding period in FY24. The Centre aims to raise gross tax revenue of Rs 38.40 trillion in FY25, according to the Budget. The Budget set a target of Rs 22.07 trillion from direct taxes and Rs 16.33 trillion from indirect taxes. The Government collected Rs 19.58 trillion as net direct tax in FY24. That is 17.1% more than in the previous financial year. Collection exceeded the estimates by Rs 13,000 crores. In FY23, direct tax collection was Rs 16.64 trillion and Rs 14.08 trillion in FY22.